A Chargeback is a dispute initiated by a cardholder with their bank against a transaction on their credit card. They are meant to protect consumers from unauthorized transactions or as consumer protection for products and services.

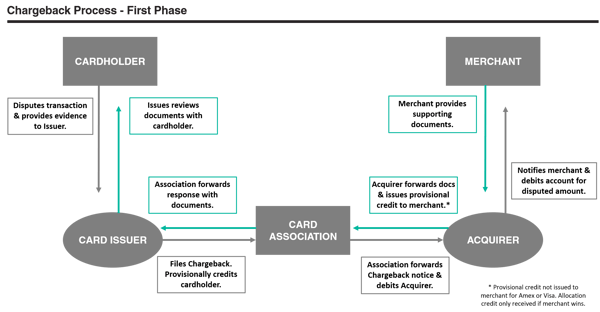

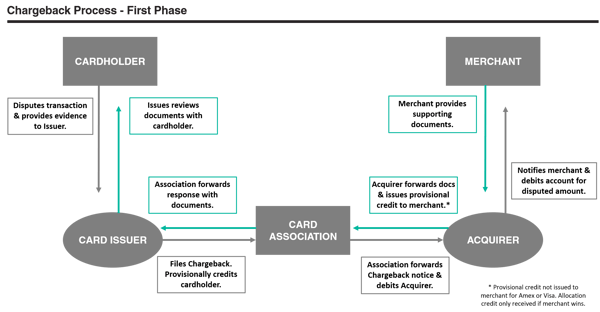

When a cardholder notices a fraudulent transaction on their bank statement or has a problem with a purchase and is unable to resolve the issue with the merchant, they can file a Chargeback. To do this the cardholder contacts the issuing bank for their card and files a dispute. The bank will ask about the nature of the dispute and request any supporting evidence if required. Once the claim is opened, the bank will select the appropriate reason for the dispute and submit the dispute claim into the card association dispute portal. This is where the acquiring bank that represents the merchant will be notified.

On the Merchant side, they are notified by their acquiring bank, requesting information to support the validity of the transaction. The reason for the dispute will determine what is required to respond. The Merchant has a set amount of time to respond with documents to support the sale, and once support is sent to the Acquirer they will review for missing data, then forward the evidence to the bank through the association portal.

What should I do if I receive a Chargeback?

- Contact your customer to confirm the validity of the dispute.

- See if you can resolve the customer's concerns.

- Verify whether the dispute was a mistake. If it was a mistake, check to see if the customer will cancel the dispute with their bank and provide a letter stating the transaction is valid. Forward this letter to your Acquirer to use as a response document.

- Both steps must be done to ensure the quickest resolution to the dispute.

- Gather all supporting documentation for the transaction.

- Send all documents, letters and supporting data to your Acquirer for review.

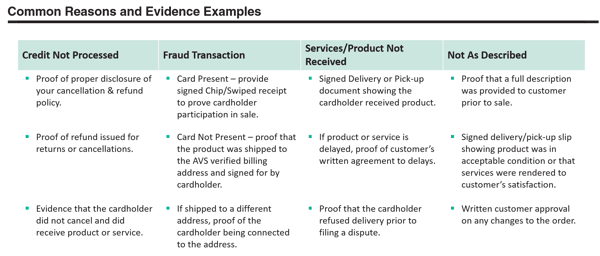

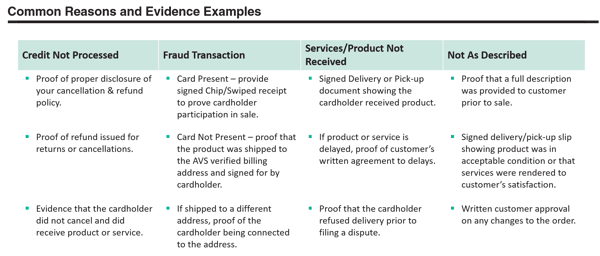

Each card association sets its own dispute rules, reason codes, and requirements for response documents but there are similarities between all of them. Here are a few examples:

How do I prevent Chargebacks in the future?

Chargebacks are an inherent risk of accepting credit card payments, and there is no way to guarantee you will never receive a dispute. However, you can take steps to reduce your risk.

- Chip/Swipe all transactions if possible.

- If you receive a declined authorization, ask for a different form of payment.

- If the card is not present, always verify Address and CVV for an exact match.

- Ship product to a verified billing address and require signature delivery.

- Require signature or other acknowledgment agreeing to services/product being as described.

- Issue refunds promptly, do not delay refunds when requested.

Possible Red Flags

- Bulk orders - orders which seem to be outside of normal order quantities.

- Orders for big-ticket items from unknown customers - vet new customers ordering items that have significant dollar value or high resale value.

- Multiple orders within a short time frame – repeat orders from one customer in a short time frame may signify unauthorized card use or card testing.

- Non-matching delivery and billing addresses – these may be valid transactions but warrant further scrutiny to ensure cardholder participation.

- New customers demanding overnight or rush delivery of big-ticket items – these behaviors can be a sign of possible fraud.

- Multiple authorization attempts declined for CVV or expiration date non-match.

- Orders split between multiple card numbers.

Proper Disclosure

Properly disclosing your cancellation and refund policies will also reduce your chargebacks and allow you to dispute claims of credit not processed. The card associations have very specific rules and requirements for what the deem Proper Disclosure.

Disclosure for Card-Present Merchants

- Pre-print policies on a contract or written on sales receipts (near the cardholder signature).

- If applicable, clearly print, “no exchange, no refund,” etc. in ¼ inch lettering on sales draft near/above cardholder signature.

- If the return policy is on the back of a receipt and is been signed on the front, the cardholder must initial near policy. Return policies on the back of a receipt without signature/initials indicate a lack of proper disclosure.

- Likewise, if a customer signs a contract and the cancellation policy is in the middle of the contract text, the cardholder needs to sign/initial next to it.

Disclosure for Card-not-present Merchants

Phone Order

- Refund and credit policies must be mailed, emailed, or texted to the cardholder before the transaction being processed. For the disclosure to be “proper,” merchant needs to be sure cardholder received/acknowledged policy.

Internet or Application

- Communicate refund policy to the cardholder on a website in one of these locations:

- In the sequence of pages before final checkout, with a “click to accept” or another acknowledgment button, checkbox, or location for an electronic signature.

- On the checkout screen, near the “submit or click to accept button”.

- Disclosure cannot solely be on a link to a separate web page.

Explore all the ways we're giving businesses the power to grow faster and do more with their money.