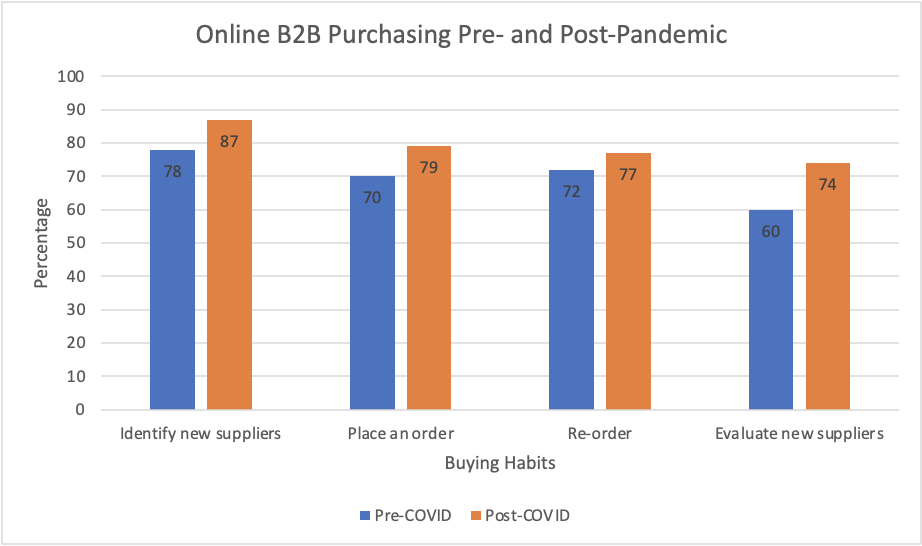

Business buyers continue to step up their digital purchasing, using the web to identify and evaluate new suppliers and place orders at a significantly higher rate than they did pre-COVID.

Here’s a before-and-after snapshot courtesy of a recent survey by ecommerce technology services company Sana Commerce:

This latest survey simply confirms a trend toward digital purchasing that began before the pandemic. For example, 2019 marked the first year that fewer than half of B2B payments were made by check, a study by the Association for Financial Professionals (AFP) found.

With face-to-face sales curtailed, self-service and sales via the web were critical during COVID-19. Buyers discovered that websites and ecommerce make it much easier for them to do research, purchase products, and arrange for service. And buy they did. One estimate valued the global B2B ecommerce market at $14.9 trillion in 2020, more than five times larger than the B2C market.

Not surprisingly, most people don’t want to give up the convenience of ecommerce even after the pandemic ends. Only about 20% of B2B buyers say they hope to return to in-person sales, recent McKinsey research shows.

And that development has significant implications for B2B sellers going forward. If they want to keep and grow their business, speed and ease are paramount. In a world where personal purchases can be made with only a few clicks, B2B transactions need to be just as fast and just as seamless.

Two Imperatives for B2B Ecommerce

B2B sellers need to offer online purchasing and payment options that look more like B2C offerings. Ecommerce sites for consumers remain significantly more user-friendly and easier to navigate, and they also are more likely to provide useful features that facilitate sales, PYMNTS.com research indicates. For example, according to that research, 11% more B2C sites currently allow users to rate products or write reviews than B2B sites. To meet customer expectations, B2B firms must catch up – or at least get closer – to the look, feel, and function of retail B2C sites.

In addition to ratings and reviews, other effective ways to make websites purchasing- and payment-friendly include:

- A convenient search function. Customers need to be able to find what they want quickly and easily.

- A wide range of payment methods. Offering multiple payment methods can boost sales – in some cases, by nearly 30%, one study showed.

- A simple checkout process. Several common checkout practices get in the way of a completed sale: requiring registration before purchase, re-entry of payment details, and complicated, multi-page forms.

- A trusted experience. Deploying a hosted payments page not only creates a consistent and seamless brand experience, which builds trust in the process itself, but the page can also reinforce the security protecting your buyer’s payment submission.

- Optimization for mobile. Websites using a mobile-first approach leverage the unique aspects of mobile devices (screen size, touch screens, vertical orientations, etc.). Text size, navigation, link placement, and fast page loading all are important.

The ability to receive and pay invoices electronically is critical to reducing friction for customers who prefer digital payment options. As indicated earlier, checks aren’t and may never be completely dead – but they are falling out of favor and probably will continue to do so. At this point, 81% of businesses continue to use paper checks in some form, but only 40% are satisfied with them, according to a PYMNTS.com research report.

Companies should carefully consider which online or electronic payment methods or features could prove most beneficial to their clients who still pay by check. Those could include electronic invoicing, which is easier, faster, and less expensive than manual invoices paid by paper checks. Customers can click a link in an email or invoice, open a secure payment page, and immediately input payment.

In fact, an APQC study found that businesses that send 80% or more of their invoices electronically have significantly lower days sales outstanding: 30 days versus 55 days for companies that e-invoice 20% or less of the time.

Text-to-Pay is another quick and convenient option that helps businesses get paid faster. Also known as SMS (Short Messaging Service) payment, Text-to-Pay allows customers to make a payment via texting on their smartphones. A business sends a notification via text when an invoice payment is due. Customers can authorize the payment with a simple reply to the text on a smartphone.

Online Is In and Here to Stay

The path ahead for B2B payments is clear: with the advantages it offers to both buyers and sellers, online is in and here to stay. As ecommerce grows, so will the businesses that embrace it. B2B sellers who ignore the trend do so at their peril. So if your ecommerce and electronic capabilities aren’t where they need to be, overhaul your website and payment processes. Make sure you’re ready to take advantage of those 80% of B2B buyers who are going to stick with online sales, pandemic or no pandemic.

If you want to learn all the ways MerchantE can help you optimize how you accept payments and expand your revenue, watch our Money In video.